After years of planning, China now dominates the world’s production of new generation batteries that are key to transitioning away from fossil fuels. These new batteries are essential for electric vehicles and most portable consumer electronics such as cell phones and laptops.

By 2040, energy analysts estimate over half of all passenger vehicles sold worldwide could be electric, according to 2019 report by Bloomberg New Energy Finance. They expect a similar percentage of light commercial vehicles in the U.S., Europe and China sales will be electric within that time, BNEF predicts.

If current trends continue, most of them will likely use Chinese batteries, a key element for transitioning away from fossil fuels, and most of those batteries will be lithium-ion, which are also popular for cellphones and laptops because of their high energy per unit mass relative to other electrical energy storage systems, according to the U.S. Department of Energy.

“Looking at the global automotive industry chain, China, for the first time, has taken the lead in the world in the manufacturing of key parts,” state media Xinhua said in August in a report titled “China’s dominant position in batteries needs to be further consolidated.”

Switching from oil

As the United States and China face off over advanced communication technologies like 5G, the world’s battery supply is not yet a major issue. But it will likely grow in importance if the U.S. continues to transition away from fossil fuel energy sources for items such as vehicles, power grids, mobile phones and laptop computers.

And that could make the global battery supply an issue of national security.

For nearly half a century, American politicians have sought to protect the country from disruptions caused by foreign oil producers.

“All of our national security decisions were set against the backdrop of what they might mean to our energy security, following the 1973 Yom Kippur war when Egypt and Syria invaded Israel and the Arab nations cut off supplies to the US and allies who helped Israel.” Dan Kish, senior vice president for policy at the American Energy Alliance, a not-for-profit energy advocacy organization, told VOA.

In 2019, the U.S. achieved its long-held goal of energy independence” producing enough oil and gas for its domestic needs.

The achievement points to the challenge of controlling the raw materials that will power the world’s next energy revolution. According to the U.S. Geological Survey (USGS), last year the U.S. imported 78% of its cobalt, and all of its graphite. For the foreseeable future, the country will likely need to depend on Chinese supply chains to produce the batteries that help power America’s economy.

Graphite, cobalt, lithium

According to data released from Benchmark Mineral Intelligence, a London-based research firm for the lithium-ion battery industry, in 2019, Chinese chemical companies accounted for 80% of the world’s total output of raw materials for advanced batteries.

“Of the 136 lithium-ion battery plants in the pipeline to 2029, 101 are based in China,” the firm said in May.

“China controls the processing of pretty much all the critical minerals, whether it’s rare earth, lithium, cobalt or graphite,” Pini Althaus, the chief executive of USA Rare Earth, said in a telephone interview with VOA.

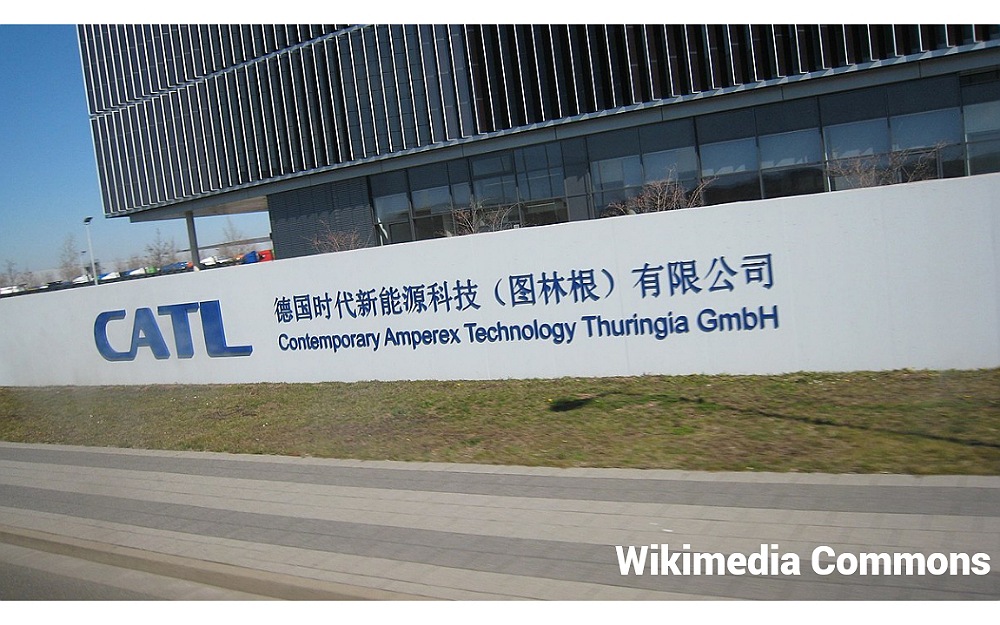

A little-known Chinese company that was founded in 2011 is now the world’s biggest maker of electric vehicle batteries.

For three consecutive years ending in 2019, South Korea’s market tracker SNE Research has ranked China’s Contemporary Amperex Technology Co. Ltd. (CATL) as No. 1 in the electric vehicle battery production, with a 27.9% market share. CATL makes electric-car batteries for Tesla.

CATL hairman Zeng Yuqun told Bloomberg last month that they have developed a power pack that lasts more than a million miles. Among their top customers are Daimler AG, BMW and Toyota.

Battery supply chain

China has focused on building capacity at every stage of the battery supply chain.

In addition to rare earths, the manufacturing of lithium-ion batteries depends on some key materials like graphite, the material used in pencil tips. In 2019, China produced more than 60% of the world’s graphite, according to U.S. government research. That means Beijing can set world prices.

“This is a completely untenable situation,” said Althaus, whose company has a pilot project in Colorado with the goal of producing a full range of rare earths as well as lithium.

He said that it could take the U.S. 20 to 30 years to catch up with China. “It does not matter whether it is China or any other country. It is very dangerous if the world only depends on one country to provide key raw materials.

African cobalt, Chinese factories

Cobalt has emerged as one of the hottest commodities in the new energy revolution because it is widely used in electric vehicles as well as computer and consumer electronics. But unlike graphite, which China has significant natural reserves, the country’s cobalt reserves accounts for only about 1% of the world’s total. The Democratic Republic of the Congo (DRC) produces more than 60% of the world’s mined cobalt.

But Beijing controls the global supply of this silvery-blue metal.

According to a working paper published last year by the Organisation for Economic Co-operation and Development (OECD), eight of the 14 largest cobalt mines in the DRC are Chinese-owned and account for almost half of the country’s output.

DRC mining ownership was not always controlled by China. For example, the largest mine in DRC, the Tenke Fungurume Mine where cobalt is a by-product of its copper mining, was owned by an American company until 2016. That year, for $2.65 billion, Freeport-McMoRan Inc., a leading international mining company with headquarters in Phoenix, Arizona, sold its mine to China Molybdenum.

China’s influence dominates cobalt processing with Chinese companies controlling about 80% of the cobalt refining industry, where it is turned into commercial-grade cobalt metal and power, according to Benchmark Minerals.

World lithium reserves

China is among the five top countries with the most lithium resources, according to the 2020 USGS, but it has been buying stakes in mining operations in Australia and South America where most of the world’s lithium reserves are found.

China’s Tianqi Lithium now owns 51% of the world’s largest lithium reserve, Australia’s Greenbushes lithium mine. In 2018, the same company also paid about $4 billion to become the second-largest shareholder in Sociedad Química y Minera (SQM), the largest lithium producer in Chile.

Another Chinese company, Ganfeng Lithium, now has a long-term agreement to underwrite all lithium raw materials produced by Australia’s Mount Marion mine, the world’s second-biggest, high-grade lithium reserve.

Escaping from Scam Center on Cambodia’s Bokor Mountain

UN Security Council Meets to Discuss Children and Armed Conflict

10 Shocking Revelations from Bangladesh Commission’s Report About Ex-PM Hasina-Linked Forced Disappearances

Migration Dynamics Shifting Due to New US Administration New Regional Laws

UN Security Council Meets to Discuss the Maintenance of International Peace and Security and Artificial Intelligence

Winter Brings New Challenges for Residents living in Ukraine’s Donetsk Region

Permanent Representative of Israel Briefs Press at UN Headquarters

Hospitals Overwhelmed in Vanuatu as Death and Damage Toll Mounts from Quake

Subscribe Our You Tube Channel

Fighting Fake News

Fighting Lies