From elephant pants to kettles and shoes, mass-made products from China are squeezing local competition.

Jitsiree Thongnoi/Bangkok

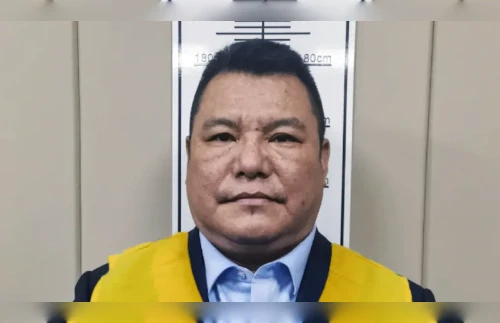

Phorntep Daechowzethsiri is a manufacturer and seller of a Thai menswear brand that prides itself on affordable and comfortable garments made from locally sourced premium cotton.

But Phorntep says he’s run into fierce competition in recent years from Chinese manufacturers who mass produce men’s leisure wear such as shirts, underwear and other items of lesser quality but sell them to Thai customers online for up to 10 times cheaper.

“The pricing is very aggressive. I could sell a T-shirt for 200 baht (U.S. $5.50) while there are plenty from Chinese manufacturers that are sold for 20 baht (55 cents) online,” Phorntep, owner of the TEPP clothing brand who sells his products via online platforms and a store in central Bangkok, told BenarNews.

“When customers see that, they prefer to buy it regardless of how long the product will last or the general quality.”

From apparel to electronic devices and vegetables, a glut of cheap Chinese goods in Thailand has seen the country’s trade deficit with China rise in recent years to a record $36.6 billion in 2023, up from $29.2 billion in 2021, according to the Thai Ministry of Commerce.

Because he can’t come close to matching his Chinese competitors on the price, Phorntep says his plan is to focus more on branding his line by emphasizing the quality and design of his products, which carry the “Made in Thailand” label.

Phorntep partners with a local factory, which employs 12 people who work specifically for his brand.

Still, there is a limit to the plant’s capacity as it can produce around 500-1000 items per design, Phorntep said. He himself travels to China often to select pieces of clothing to increase the variety of his collections.

Among foreign imports, electronics represent the top category of Chinese goods that have penetrated the Thai market, followed by fresh and processed vegetables and fruits, clothing and shoes, home decor items and kitchen appliances, according to Kasikorn Research, a local economics think-tank.

The Federation of Thai Industries said that small and medium-sized enterprises (SME) companies were most affected by the flood of Chinese goods.

Other industries have seen a devastating effect. Thailand is looking to impose a new round of anti-circumvention measures against imports of Chinese steel and steel products. The first 10 months of 2023 saw about 75 local steel companies and mills shutter as a result of dumping by China, the Commerce Ministry said.

Price war

In February, the administration of Prime Minister Srettha Thavisin began mulling the possibility of charging a value-added tax for all imported goods regardless of their value.

A levy in place since 2018 has applied only to imports valued at more than 1,500 baht (U.S. $41). The new measure to impose VAT on all imported goods has not yet been implemented.

The government began considering it after Chinese-made elephant pants faced an import ban. The baggy garments were being marketed in Thailand at a much lower price than locally made elephant pants.

The influx of these mass-produced pants drew an outcry from customers and manufacturers who saw this as treading on one of Thailand’s most iconic clothing items.

Some Thai manufacturers criticized the Chinese variety as being of inferior quality compared with those made locally from superior textiles, according to media reports.

The influx of goods from China has also led to Chinese entrepreneurs setting up shop in Thailand, further undermining local business, said Natawaj Pusiriwaj, a Thai clothes retailer.

Natawaj said he imports clothes from China because of their cheap cost, and he sells them at his store at Pratunam Market, a wholesale center in Bangkok.

However, Chinese clothes sellers who also operate in the same area, have a competitive edge.

“I import clothes from China through a Chinese agent, or sometimes I travel to China to select goods,” Natawaj said. “But for Chinese who are based in Thailand, they can contact the factory in China directly and even tell them what style of clothing is popular in Thailand right now to manufacture.”

Other local manufacturers realize that their costs and the technology of mass-scale production lag behind China’s.

Sompop Suenoppakool, a clothes manufacturer, said pricing was not the only factor that makes Chinese goods competitive in the Thai market.

“I think there are plenty of Chinese goods that are highly priced and have good quality. But the point is China has a production and logistical means that allows producers to control the costs.”

Visit Limlurcha, vice chairman of the Thai Chamber of Commerce, said the deluge of cheap Chinese goods would continue around the world because of China’s currently sluggish economy.

“Due to the slow consumption in China, there are supplies of goods that need to be distributed globally and that starts to affect many countries,” he said.

Thailand can take advantage through other means like “persuading Chinese producers to set up their manufacturing bases here so there can be revenue that generates from other types of economic activities in Thailand, like employment,” Visit said.

China, one of Thailand’s top trading partners, was also its biggest source of foreign investment applications in 2023, topping Singapore, the United States and Japan.

Applications for investment promotion in 2023 reached a five-year high of 848.3 billion baht ($23.1 billion), marking an increase of 43% from the previous year, according to Thailand’s Board of Investment. That growth was boosted by Chinese firms, especially in the electronics and electric vehicles industry, the Board said.

Meanwhile, in a report published in March, KKP Research, another think-tank, said Thai exports were weaker because the nation’s production sector was unable to keep up with the changing technology and markets, and was also being undermined by the influx of cheap Chinese goods.

“The technology shift is not an easy task in Thailand. There must be enough competitive advantages, or a clear support from the government, or a shift in laborers’ skills. We have none of that at the moment,” Jitipol Puksamatanan, the head of global investment strategy at Finansia Syrus Securities, told BenarNews.

Copyright ©2015-2024, BenarNews. Used with the permission of BenarNews