Wilawan Watcharasakwet/Bangkok

Napawan Rimwaan used a phone app to borrow 2,000 baht (U.S. $55), believing it was an interest-free loan that she could pay back in 90 days.

A week later, an agent from the lending agency started calling and threatening the Thai mother of two to repay the loan – along with a 31 percent interest charge – within seven days.

“I just wanted to buy a school uniform for my child,” Napawan, 38, told BenarNews while unable to hold back tears. “Now, my children will have to eat rice with just sauce.”

Those were not the terms Napawan said she agreed to, a tell-tale sign of the type of illegal money-lending services that have thrived across Thailand and preyed on people hard up on cash during the COVID-19 pandemic, according to Thai police. The authorities, who have been cracking down on such illegal loan operations, estimate these criminal enterprises brought in millions of baht from unsuspecting customers.

After the lending agents called Napawan more than 10 times a day, she called a police hotline.

“Police told me to calm down, saying they [the loan sharks] could not harm me,” recalled Napawan, noting that she had just recovered from COVID-19.

As the pandemic spread across Thailand, many fell prey to such illegal operations because they had no access to legitimate loans during hard times, a senior police investigator said.

“The pandemic affected all businesses from street vendors to small and medium enterprises. Many businesses froze or shut down,” said Col. Padol Chandon, a superintendent with the national police’s Economic Crime Suppression Division (ECD).

“When the country eased the lockdown, everybody started looking for funds to restore their business, and the loan sharks were ready to prey,” he told BenarNews.

Online money lending, including smartphone app-based services, replaced traditional bank loans for many people because they offered easy approval without proper documents or credit checks. For some of the victims, it only took them a few minutes to borrow a few thousand baht.

“That is why the interest rate is very high,” Padol said, adding lenders know what they are doing is illegal.

From January to June, authorities arrested nearly 100 people suspected of links to illegal loan syndicates, according to the ECD.

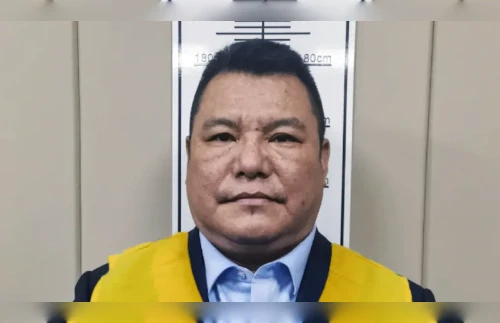

In July, the department cracked down on the largest syndicate, arresting nearly 40 suspects identified as members of three networks in the northeastern provinces of Maha Sarakham, Roi-Et and Kalasin. Police said the syndicate was led by Sawek Manpan, 43, a former debt collector who had been arrested and jailed five years earlier on similar charges.

One month earlier, a police task force cracked down on the largest loan-sharking website, when they arrested 29 suspects from five networks in Bangkok, Chanthaburi, Khon Kaen, Pathum Thani, and Nakhon Ratchasima provinces.

Padol identified the mastermind of the website-based network as Aniwat Buayai, 26, who started his business just two years ago with about 200,000 baht ($5,460).

ECD investigators allege that Aniwat began by loaning money to impoverished street vendors who asked for a few thousand baht. Later, he expanded his business to target owners of small and medium enterprises that needed 100,000 to 2 million baht ($2,731 to $54,630) within days to keep their pandemic-hit companies afloat, police said.

Aniwat allegedly hired “young thuggish men” to work as debt collectors by offering them free housing, cars and large commissions on money they collected, police said.

When police picked him up, Padol said they found about 500 million baht ($13.6 million) in Aniwat’s bank account.

“He confessed that he learned how to manage the loan-sharking business from social media. It’s a copycat behavior,” Padol told BenarNews. “It’s a high-risk, high-return game.”

Both Aniwat and Sawek face a series of criminal charges including operating illegal money-lending services and providing personal loans at extortionate rates. In addition, Sawek and his gang have been charged with collecting debts by using intimidation and violence.

In June 2020, three months into Thailand’s COVID-19 lockdown, the Royal Thai Police established the Center for Countering Abuse by Loan Sharks after receiving increasing complaints from victims reporting physical intimidation.

So far, police have investigated more than 7,000 cases. The center’s hotline had received about 4,000 calls a month for eight months ending in June, but could only respond to a quarter of them because of a lack of resources.

Still, police arrested 833 loan shark suspects in those eight months, froze 254 bank accounts, impounded hundreds of cars and motorcycles and seized 1.49 million baht ($49,780) in cash. The center estimated the value of assets confiscated to be more than 31 million baht ($852,600).

Authorities said several suicides have been blamed on threats from loan sharks in the past two years.

“I’m sorry. I’m tired. Do not pay the loan shark. They already earned too much from the overcharge interest rates,” said a hand-written suicide note left by a bread factory owner who took his own life in May.

‘I fear for my daughter’s safety’

Not all victims reach out to police.

A Thai social activist told BenarNews that his team receives about 10 loan-related complaints daily.

“They are increasing dramatically and debt collectors are using intimidation tactics and threats of violence, including an attack on life, destruction of houses, seizure of properties … and even shooting,” said Eakpob Laungprasert, founder of Facebook page Saimai Tong Rod, or Saimai Must Survive, which helps people who fell into hard times after contracting COVID-19.

Recently, Eakpob took street vendor Jiraporn Thepabutra and her 8-year-old daughter to a police station after debt collectors stopped them from entering their house and sent life-threatening messages because she could not pay a loan and interest after contracting COVID.

“Watch your back. You took our money; you will not live. Return the money now. Or I will burn down your house,” said one message viewed by BenarNews.

Jiraporn, 44, said she had to pay 400 baht (about $11) a day on the 20,000 baht ($546), which she borrowed at 60 percent monthly interest. The lender told her to borrow more money to pay off the debt when she said she could not work because she was infected with COVID-19.

She said debt collectors sent threatening texts every day. They also lurked around her house, knocked on her front door and threw small rocks onto her roof.

One night, Jiraporn and her daughter could not enter their home because the debt collectors had super glued the keyholes on the door’s padlocks and pasted a poster on the door that read: “Return my money.”

She said she sat on the street crying for nearly three hours before calling Eakpob for help.

“My loan application was rejected from the bank, so I decided to go to the loan sharks because I needed to pay rent, tuition fee for my daughter, and some cash to restart my business,” Jiraporn told reporters in Bangkok.

“I’m so scared they would attack me. I fear for my daughter’s safety,” she said as tears rolled down her face. “I can’t live like this anymore. I don’t want to owe anyone any money.”

Eakpob said street vendors are most vulnerable during the pandemic because they are informal workers and do not have access to financial institutions.

His team negotiates with creditors on behalf of such debtors while working with police to report possible crimes.

The government, Eakpob said, should set up emergency funds in every district during these hard times.

“The funds should be easily accessible, the approval should be quick and the loans should have normal interest rates,” he said.

Copyright ©2015-2022, BenarNews. Used with the permission of BenarNews.