The euro currency turns 20 years old on January 1, surviving two tumultuous decades and becoming the world’s No. 2 currency.

After 20 years, the euro has become a fixture in financial markets, although it remains behind the dollar, which dominates the world’s market.

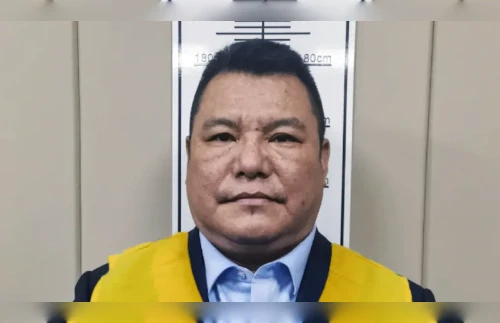

Banknotes Euros by Axelle B is licensed

under CC0 Public Domain

The euro has weathered several major challenges, including difficulties at its launch, the 2008 financial crisis, and a eurozone debt crisis that culminated in bailouts of several countries.

Those crises tested the unity of the eurozone, the 19 European Union countries that use the euro. While some analysts say the turmoil and the euro’s resilience has strengthened the currency and made it less susceptible to future troubles, other observers say the euro will remain fragile unless there is more eurozone integration.

Beginnings

The euro was born on January 1, 1999, existing initially only as a virtual currency used in financial transactions. Europeans began using the currency in their wallets three years later when the first Euro notes and coins were introduced.

At that time, only 11 member states were using the currency and had to qualify by meeting the requirements for limits on debt, deficits and inflation. EU members Britain and Denmark received opt-outs ahead of the currency’s creation.

The currency is now used by over 340 million people in 19 European Union countries, which are: Austria, Belgium, Cyprus, Estonia, Finland, France, Germany, Greece, Ireland, Italy, Latvia, Lithuania, Luxembourg, Malta, the Netherlands, Portugal, Slovakia, Slovenia and Spain.

Other EU members are required to join the eurozone when they meet the currency’s monetary requirements.

Popularity

Today, the euro is the most popular than it has ever been over the past two decades, despite the rise of populist movements in several European countries that express skepticism toward the European Union.

In a November survey for the European Central Bank, 64 percent of respondents across the eurozone said the euro was a good thing for their country. Nearly three-quarters of respondents said they thought the euro was a good thing for Europe.

In only two countries — Lithuania and Cyprus — did a majority of people think the euro is a bad thing for their nation.

That is a big contrast to 2010, the year that both Greece and Ireland were receiving international bailout packages, when only 51 percent of respondents thought the euro was a good thing for their country.

Challenges

The euro faced immediate challenges at its beginning with predictions that the European Central Bank (ECB) was too rigid in its policy and that the currency would quickly fail. The currency wasn’t immediately loved in European homes and businesses either with many perceiving its arrival as a price hike on common goods.

Less than two years after the euro was launched — valued at $1.1747 to the U.S. dollar — it had lost 30 percent of its value and was worth just $0.8240 to the U.S. dollar. The ECB was able to intervene to successfully stop the euro from plunging further.7

The biggest challenge to the block was the 2008 financial crisis, which then triggered a eurozone debt crisis that culminated in bailouts of several countries.

Tens of billions of euros were loaned to Greece, Ireland, Portugal, Cyprus and Spain, either because those countries ran out of money to save their own banks or because investors no longer wanted to invest in those nations.

The turmoil also highlighted the economic disparity between member states, particularly between the wealthier north and the debt-laden southern nations.

Poorer countries experienced both the advantages and disadvantages to being in the eurozone.

Poorer countries immediately benefited from joining the union, saving trillions of euros due to the lowering borrowing costs the new currency offered.

However, during times of economic downturn, they had fewer options to reverse the turmoil.

Typically in a financial crisis, a country’s currency would plunge, making its goods more competitive and allowing the economy to stabilize. But in the eurozone, the currency in poorer countries cannot devalue because stronger economies like Germany keep it higher.

Experts said the turbulent times of the debt crisis exposed some of the original flaws of the euro project.

However, the euro survived the financial crisis through a combination of steps from the ECB that included negative interest rates, trillions of euros in cheap loans to banks and buying more than 2.6 trillion euros in government and corporate bonds.

Future

ECB chief Mario Draghi was credited with saving the euro in 2012 when he said the bank would do “whatever it takes” to preserve the currency.

Some experts say the flexibility of the bank proves it is able to weather financial challenges and say the turmoil of the past two decades have left the ECB better able to deal with future crises.

However, other observers say that the 19 single currency nations have not done enough to carry out political reforms necessary to better enable the countries to work together on fiscal policy and to prepare for future downturns.

Proposals for greater coordination, including a eurozone banking union as well as a eurozone budget are still in the planning phases~VOA